Turn Bitcoins into cash by selling them through a trusted exchange, using a Bitcoin ATM, or trading directly with others on a P2P platform. Exchanges like Coinbase and Kraken let you convert Bitcoin to USD and withdraw to your bank account. ATMs offer instant physical cash, while P2P platforms provide more flexibility with payment methods.

Key Takeaways

- You can turn Bitcoins into cash using Bitcoin ATMs, centralized exchanges, or peer-to-peer (P2P) platforms.

- Bitcoin ATMs offer instant cash access, ideal if you need to turn Bitcoins into cash instantly, often through services like CoinFlip.

- Centralized exchanges allow you to withdraw Bitcoin to a bank account, generally offering lower fees but longer processing times.

- P2P platforms provide flexible payment options, including direct cash, but require careful security measures.

- Always ensure you select the correct blockchain network to avoid losing your funds during transfer.

Popular Methods to Turn Your Bitcoin into Cash

There are several paths you can take to turn Bitcoins into cash. Each has its own advantages and disadvantages depending on how fast you need the cash, how much you’re converting, fees, and your location.

Method 1: Use Bitcoin ATMs

When you need to turn Bitcoins into cash instantly, Bitcoin ATMs are often the fastest and most convenient option. These specialized machines allow you to sell your Bitcoin for physical cash on the spot, much like a traditional ATM dispenses cash from your bank account. As Crypto ATM Experts, we’re particularly familiar with this method, especially through services like CoinFlip Bitcoin ATM.

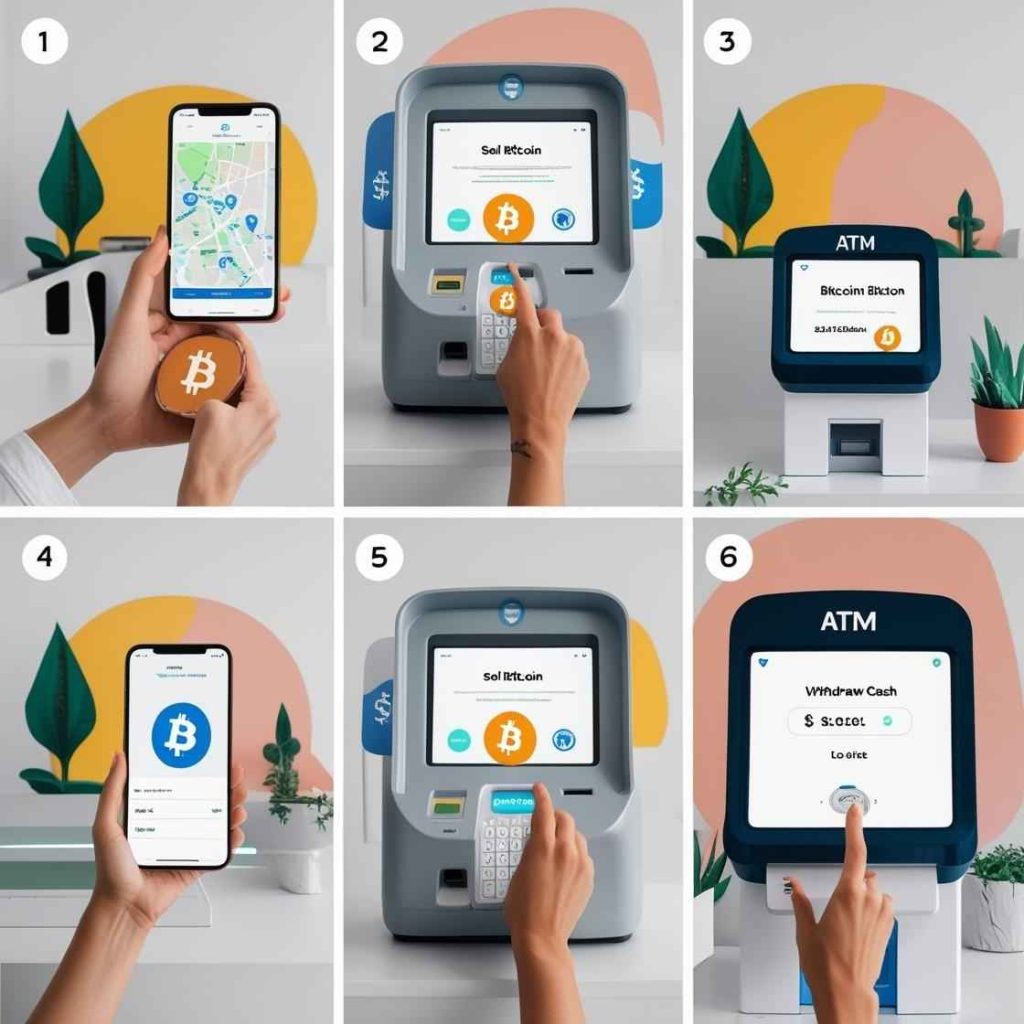

How to use a Bitcoin ATM to sell BTC for cash:

- Find an ATM: Use a locator tool like CoinFlip’s ATM finder to find a machine near you that allows Bitcoin-to-cash sales.

- Verify Your Identity: Most ATMs require verification—usually a phone number, ID scan, or basic KYC steps.

- Select “Sell Bitcoin”: Select the option to sell BTC or withdraw cash.

- Enter Amount: The ATM will calculate and show how much cash you’ll get, including any transaction fees.

- Scan Your Wallet: Send the exact BTC amount from your crypto wallet to the address shown on the ATM.

- Collect Your Cash: Once the transaction confirms (usually in a few minutes), the machine will dispense your cash.

Pros:

- Speed: Offers one of the quickest ways to turn Bitcoins into cash instantly.

- Convenience: Located in easily accessible places like convenience stores.

- Simplicity: User-friendly interface designed for straightforward transactions.

Cons:

- Higher Fees: Generally charge higher transaction fees compared to online exchanges.

- Limits: Often have daily or per-transaction limits.

Method 2: Sell via Cryptocurrency Exchanges

Another popular method to withdraw money from Bitcoin is using centralized crypto exchanges like Coinbase, Binance, or Kraken. These platforms let you sell your Bitcoin for fiat currency (like USD, EUR, or GBP) and then withdraw Bitcoin to your bank account.

How to sell Bitcoin on an exchange and withdraw to your bank:

- Choose an Exchange: Pick one that supports fiat withdrawals in your region.

- Deposit Bitcoin: If your Bitcoin isn’t already on the exchange, transfer it from your personal wallet to your exchange wallet.

- Sell Bitcoin for Fiat: Place a market or limit sell order (e.g., BTC/USD or BTC/EUR).

- Initiate Fiat Withdrawal: Once your Bitcoin is sold for fiat, go to the withdrawal section of the exchange.

- Select Bank Transfer: Choose your preferred bank transfer method (e.g., ACH, wire transfer, SEPA, Faster Payments) and enter the amount you wish to withdraw.

- Confirm Details: Review your bank details carefully and confirm the withdrawal.

Pros:

- Lower Fees: Generally offer lower transaction fees than Bitcoin ATMs.

- Higher Limits: Often allow for larger transaction volumes once KYC (Know Your Customer) verification is complete.

- Convenient for Digital Management: Integrates well if you frequently trade or manage your crypto online.

Cons:

- Processing Time: Bank transfers can take anywhere from a few hours to several business days to clear.

- KYC Requirements: Requires identity verification, which can take time.

Method 3: Peer-to-Peer (P2P) Platforms

Want to convert your Bitcoin back to cash on cash with flexibility? P2P platforms like Paxful or LocalBitcoins let you sell Bitcoin directly to another person and get paid via various methods like bank transfers, PayPal, or even cash in person.

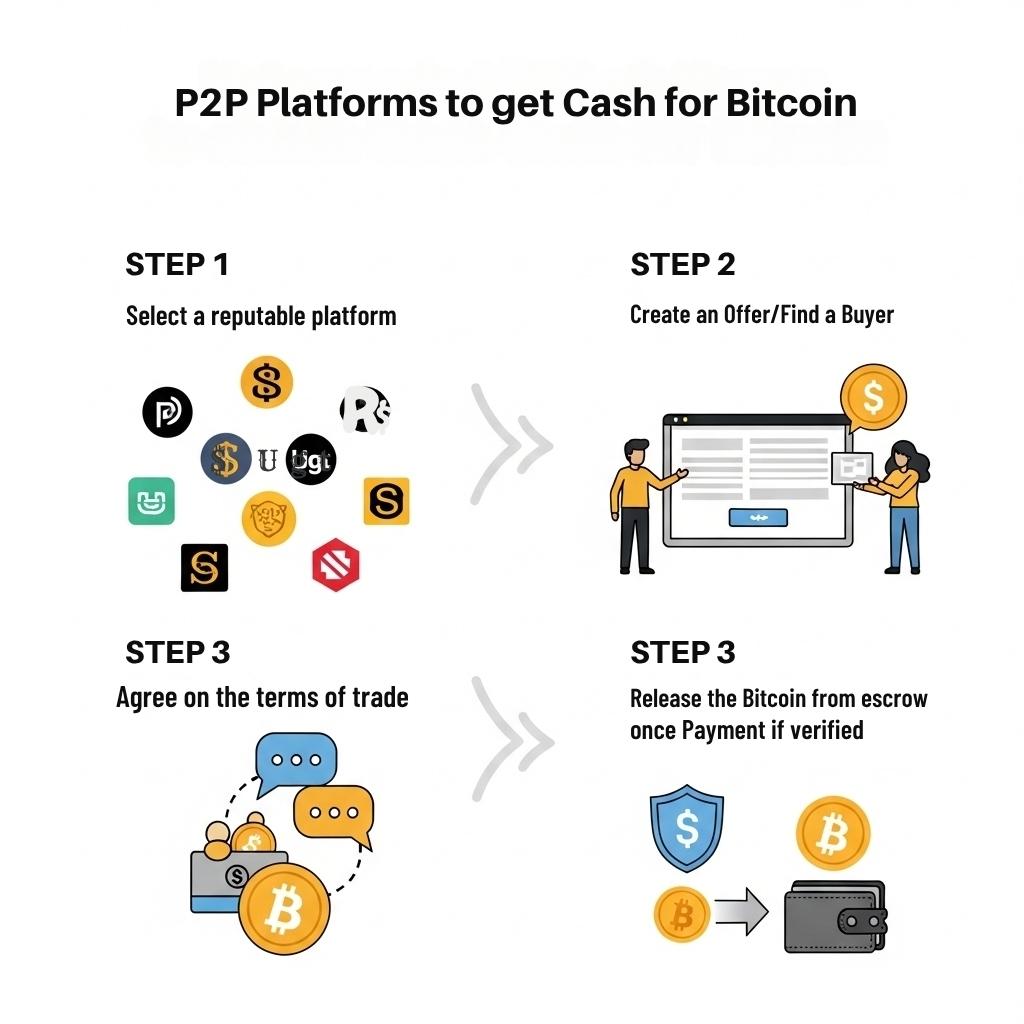

How to use P2P platforms to get cash for Bitcoin:

- Choose a P2P Platform: Select a reputable platform that facilitates P2P trading.

- Create an Offer/Find a Buyer: Choose how much BTC you want to sell and your preferred payment method.

- Agree on Terms: Once matched, you’ll communicate with the buyer to agree on the terms of the trade.

- Release Bitcoin: Once you’ve confirmed payment (e.g., money in hand or transferred), release the BTC from escrow.

Pros:

- Flexibility: Offers a wide range of payment methods, including direct cash in hand.

- Potential for Privacy: Can sometimes offer more privacy than centralized exchanges, depending on the payment method.

Cons:

- Risk of Scams: Requires vigilance to avoid fraudulent buyers; always use the platform’s escrow service.

- Variable Speed: Transaction times can vary widely depending on the buyer’s payment method and responsiveness.

Method 4: Cash Out Bitcoin on Cash App

If you’re looking for a simple, mobile-friendly way to turn Bitcoins into cash, Cash App can be a convenient solution—especially for users based in the U.S. It allows you to sell Bitcoin directly from your balance and withdraw funds to your linked bank account.

Here the steps to sell and cash out Bitcoin using Cash App:

- Open Cash App: Make sure you have an active Cash App account with a verified identity.

- Tap the Bitcoin Tab: Navigate to the Bitcoin section by tapping the Bitcoin icon on the bottom menu.

- Select “Sell”: Choose how much Bitcoin you want to sell. You can select a custom amount or choose from preset options.

- Confirm the Sale: Review the details and confirm the sale. The BTC will be converted to USD at the current market rate.

- Withdraw to Your Bank: Go to your balance, tap “Cash Out,” and transfer the USD to your linked bank account via standard or instant deposit.

Pros:

- User-Friendly: Cash App’s interface is easy to navigate, even for beginners.

- Fast Payouts: Instant deposit to bank available (for a small fee).

- No Need for External Wallets: You can store, buy, and sell Bitcoin within the app itself.

Cons:

- Availability: Only available in certain countries, mostly U.S.-based.

- Limits: Weekly and daily transaction limits apply depending on account verification level.

- Fees: While not always transparent, Cash App charges a small spread on BTC sales and a fee per transaction.

Method 5: Using Crypto Debit Cards or Gift Cards

Not everyone needs physical cash. If your goal is to use your Bitcoin like cash in everyday life, crypto debit cards and gift card platforms are practical options.

How does it work:

You load a crypto debit card by converting some of your Bitcoin (or other crypto) to fiat on the card. You can then use this card like a regular debit card for purchases or sometimes ATM withdrawals (though withdrawal fees can be high). Alternatively, services let you use Bitcoin to instantly buy gift cards for various retailers.

Pros: Easy to spend your Bitcoin value in the real world, widely accepted where cards or gift cards are.

Cons: No direct physical cash in hand (unless using ATM withdrawal), fees may apply for loading or transactions, and exchange rates apply when converting.

Before You Cash Out Bitcoin: What to Know

- Fees: Always check the fees for each method. Bitcoin ATMs tend to be higher, while exchanges typically have lower trading and withdrawal fees.

- Limits: Be aware of daily or transaction limits for your chosen method, especially for ATMs and new exchange accounts.

- Verification (KYC): Most regulated services (exchanges, ATMs for larger amounts) require identity verification.

- Security: Always double-check addresses, use strong passwords, and enable Two-Factor Authentication (2FA) wherever possible.

- Tax Implications: Cashing out Bitcoin can trigger capital gains tax events. It’s always wise to consult with a tax professional to understand your obligations in your jurisdiction.

FAQs About Turning BTC into Cash

How long does it take to withdraw Bitcoin to a bank account?

Withdrawing Bitcoin to a bank account through a centralized exchange usually takes 1-5 business days, depending on the bank and the specific transfer method (e.g., ACH, wire transfer).

Is it safe to collect my Bitcoin Cash from an ATM?

If you’re looking to collect my Bitcoin Cash (referring to literal fiat currency from a Bitcoin transaction), using a reputable Bitcoin ATM and following all security prompts (like verifying the address and checking the amount) is a safe method. Always ensure you are at a legitimate ATM.

What are the typical fees to withdraw money from Bitcoin?

Fees vary significantly by method. Bitcoin ATMs can charge 5-10% or more. Centralized exchanges typically have lower trading fees (e.g., 0.1-0.5%) plus a small network withdrawal fee. P2P fees depend on the platform and seller.

The Bottom Line on Turn BTC into Cash

The ability to turn Bitcoins into cash is more accessible than ever before. Whether you prefer the immediate gratification of a Bitcoin ATM like CoinFlip, the widespread acceptance and lower fees of a centralized exchange, or the flexibility of peer-to-peer platforms, you have viable options to access your funds. By choosing the method that best suits your needs and following the steps carefully, you can confidently convert your digital Bitcoin into spendable cash.