Are you in need of quick cash but don’t know where to turn? Look no further! The Cash App, a popular mobile payment service, offers a feature that allows users to borrow money from Cash App . In this blog post, we’ll walk you through the simple process of borrowing money from Cash App, and provide you with some helpful tips along the way.

What is Cash App?

Before we dive into the borrowing process, let’s quickly cover what the Cash App is. The Cash App is a mobile payment service owned by Block, Inc. that allows users to send and receive money, invest in stocks and cryptocurrencies, and even borrow money from Cash App .

Why Borrow Money from Cash App?

Before diving into the steps, it’s important to understand why borrowing money from Cash App can be advantageous:

- Quick Access to Funds: Unlike traditional loans, which can take days or even weeks for approval, Cash App provides quick access to funds, often within minutes.

- Convenience: Everything is done through the app, so you don’t need to visit a bank or fill out lengthy paperwork.

- Transparent Fees: Cash App charges a straightforward fee for borrowing, with no hidden costs.

Read Also:-

How to Deposit Check on Cash App?

Steps to Borrow Money from Cash App

Here’s a detailed step-by-step guide on how to borrow money from Cash App:

Step 1 :- Open Cash App

Launch the Cash App on your mobile device and make sure you are logged in.

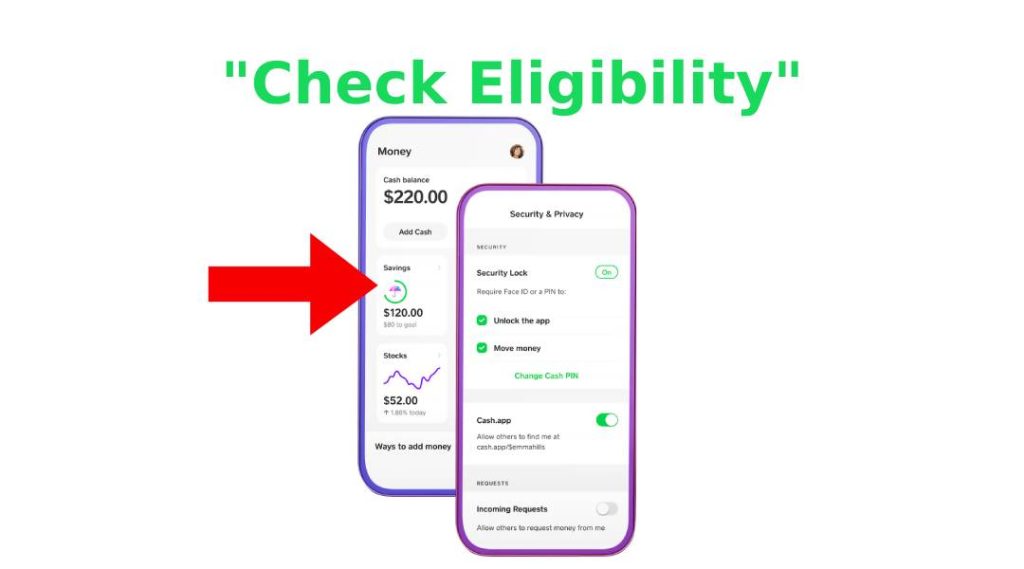

Step 2 :- Check Eligibility

Not all users are eligible to borrow money from Cash App. The eligibility is determined based on various factors such as your account history and usage. To check if you are eligible, tap on the banking tab (dollar symbol) and look for the “Borrow” option.

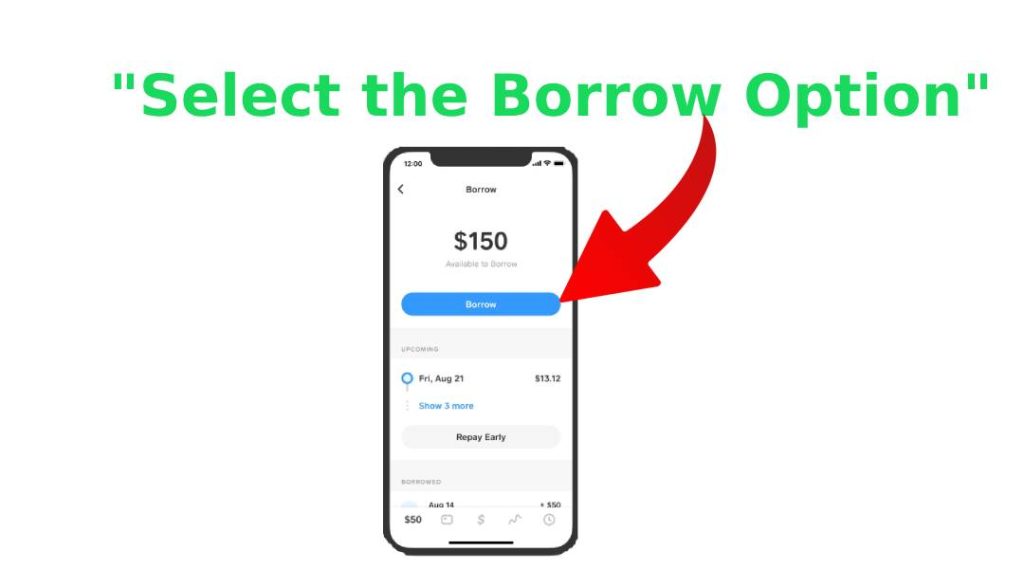

Step 3 :- Select the Borrow Option

If you see the “Borrow” option, tap on it. Cash App will show you the maximum amount you can borrow. This amount varies from user to user.

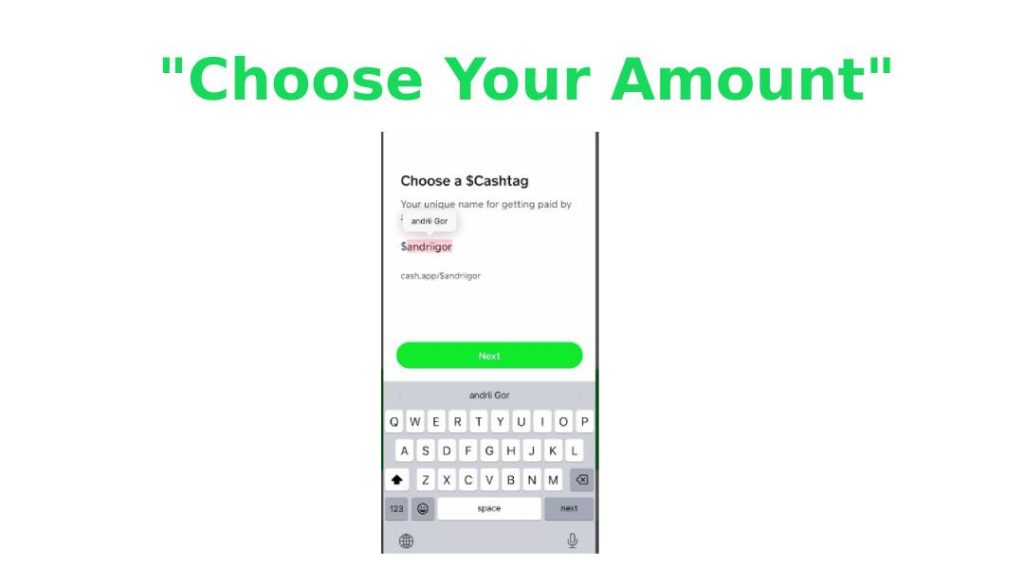

Step 4:- Choose Your Amount

Select the amount you wish to borrow. You can borrow a portion or the full amount available to you.

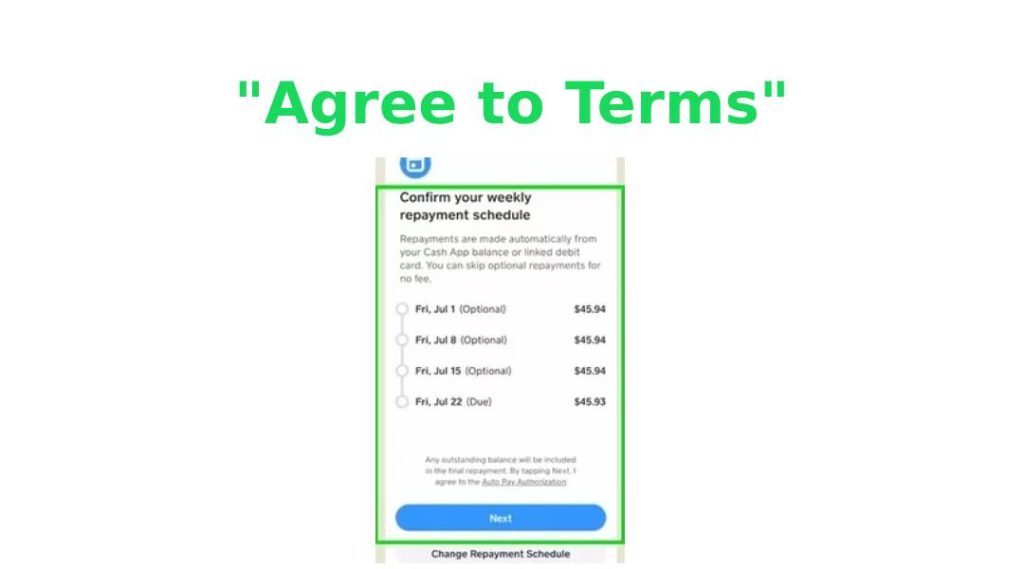

Step 5:- Agree to Terms

Read through the terms and conditions carefully. Cash App will outline the fees and repayment schedule. If you agree, proceed by accepting the terms.

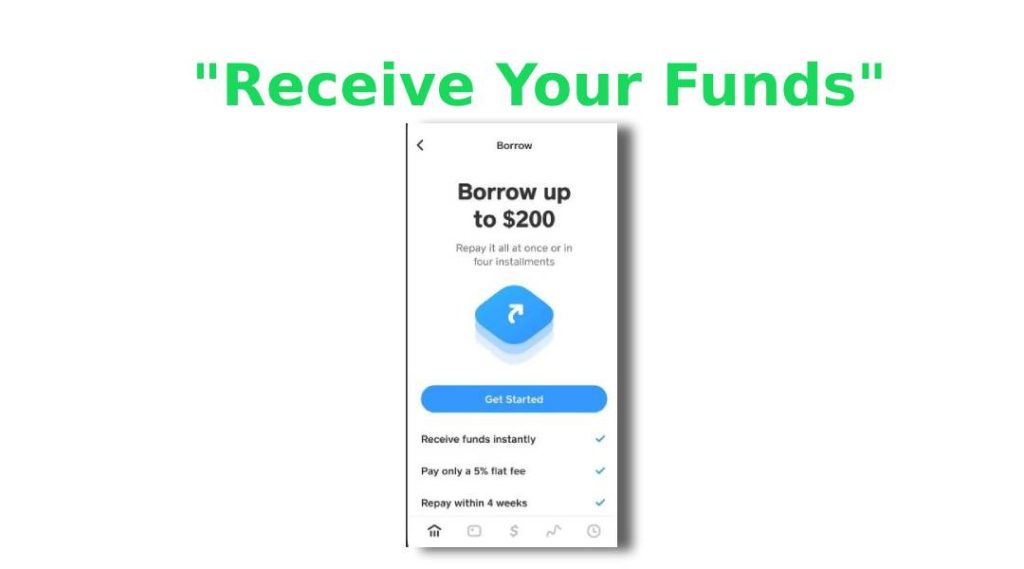

Step 6:- Receive Your Funds

Once you accept the terms, the borrowed amount will be transferred to your Cash App balance instantly.

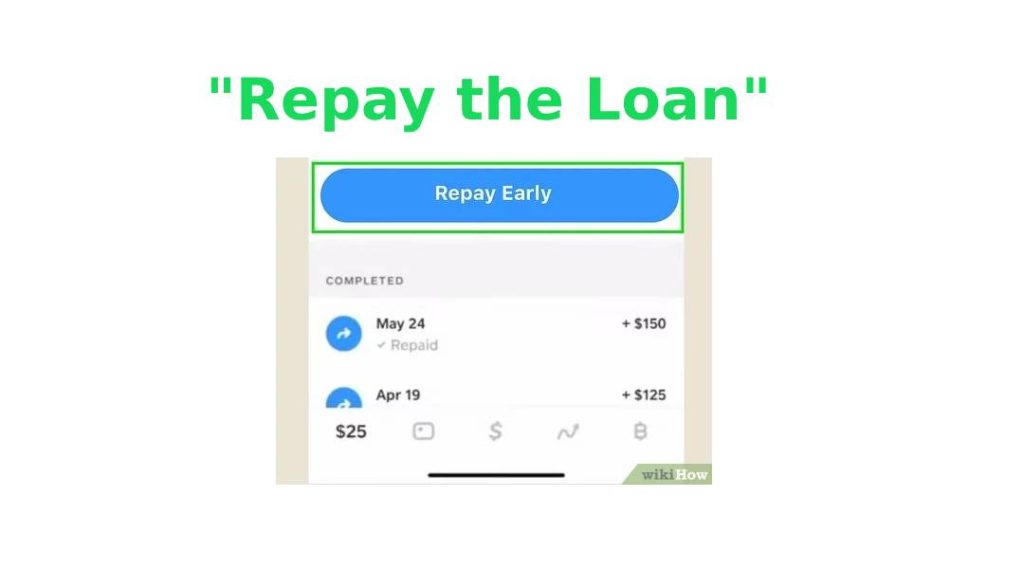

Step 7:- Repay the Loan

Repaying your loan is straightforward. Cash App will automatically deduct the repayment amount from your balance according to the schedule. Make sure you maintain enough funds in your account to avoid any issues.

Here are Some Alternative Option for Borrow Your Fund From Cash App

- P2P Lending Platforms: These platforms connect borrowers with lenders and often offer lower interest rates.

- Crypto-Backed Loans: Borrow against your existing crypto holdings, but be aware of the risk of dropping crypto value.

- Reduce Crypto Investment: Scale back your crypto investment plans to avoid needing a loan.

Tips for Using Cash App Borrow Feature Wisely

While the ability to borrow money from Cash App is convenient, it’s essential to use this feature wisely:

- Borrow What You Need: Only borrow what you absolutely need and can afford to repay. Remember, it’s a loan, not free money.

- Understand the Fees: Make sure you fully understand the fees involved and how they affect the total amount you need to repay.

- Keep Track of Repayments: Set reminders for your repayment dates to avoid late fees and maintain a good standing with Cash App.

Conclusion:-

Borrowing money from Cash App is a quick and convenient way to access funds when you need them. By following the steps outlined above, you can easily navigate the borrowing process and make the most of this feature. Remember to use this option responsibly and always be aware of the terms and conditions involved.

Related Articles for Cash App:

- Will Cash App Refund Money If Scammed?

- How to Verify Cash App Without Id [Complete Guide]

- How to Transfer Money from Venmo to Cash App [Instant Transfer]

- Cash App Login Failed: How to Fix Common Issues

Frequently Asked Questions (FAQ):-

Can Everyone Borrow Money from Cash App?

No, Cash App Borrow is an invite-only feature. Cash App doesn’t offer “borrow money from Cash App” universally. Eligibility is based on your past activity within the app, not your credit score.

How Much Can I Borrow from Cash App?

Borrowing limits are typically between $20 and $200.pen_spark

How Long Do I Have to Repay a Cash App Loan?

Cash App loans are short-term. You’ll typically need to repay the full amount within four weeks.

What Fees are Involved in Borrowing Money from Cash App?

Cash App charges a flat fee, usually around 5% of the borrowed amount.