Have you been wondering about transferring money between Cash App and PayPal? But there’s currently no direct way to send money from Cash App to PayPal. But don’t worry, you can still transfer money from Cash App to PayPal using your linked bank account as a bridge. It’s simple, secure, and doesn’t require any technical know-how.

We Can’t Directly Transfer Money from Cash App to PayPal?

While the reason behind the lack of direct transfer functionality isn’t officially confirmed, it likely boils down to competition between the two services. Cash App focuses on peer-to-peer payments and instant deposits, while PayPal leans more towards online transactions and business integrations.

Read Also:-

How to Cash Out Bitcoin on Cash App?

How to Transfer Money from Cash App to PayPal Using a Bank Account

Thankfully, there’s a reliable method to transfer money from Cash App to PayPal using bank account. Here’s a step-by-step guide:

Step 1:- Check Your Cash App Balance:

Before initiating the transfer, ensure you have sufficient funds in your Cash App balance.

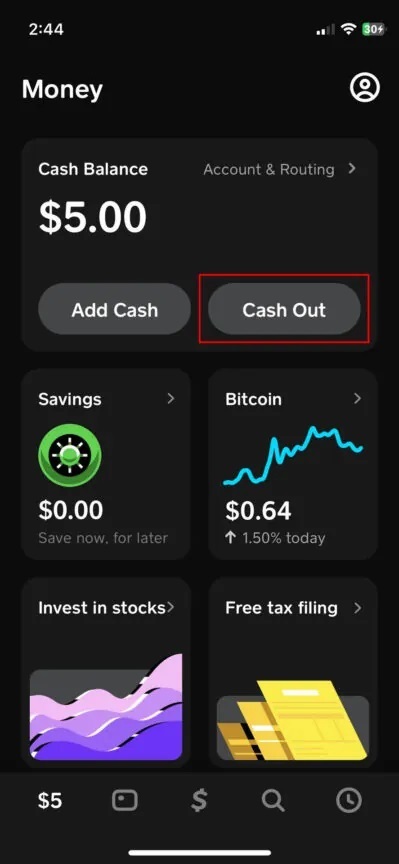

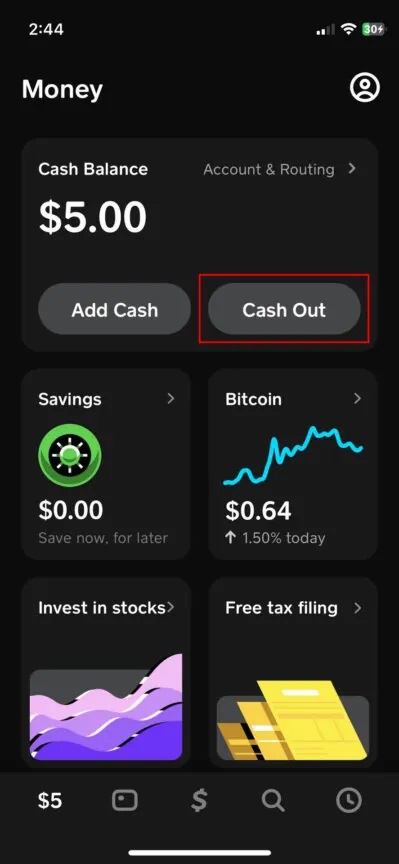

Step 2:- Cash Out to Your Bank Account:

- On your Cash App homepage, navigate to the “Banking” tab.

- Select “Cash Out” and enter the desired transfer amount.

- Choose between “Standard” (1-3 business days) for free or “Instant” (arrives within minutes) for a 1.5% fee. Confirm the transfer with your PIN or Touch ID.

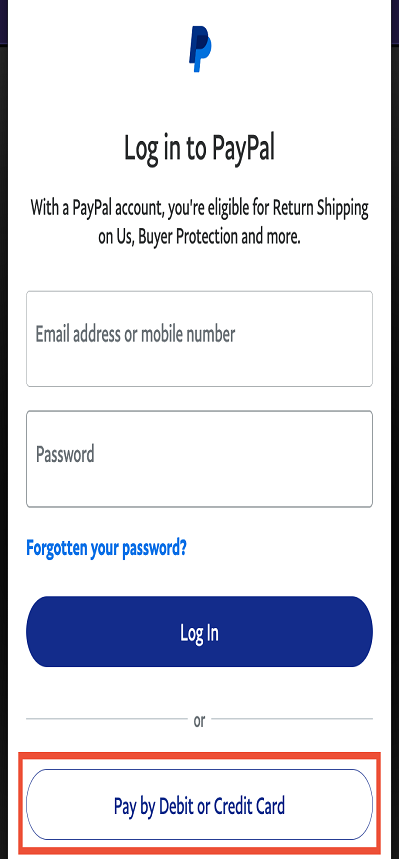

Step 3:- Log In to Your PayPal Account:

Head over to your PayPal account and navigate to the “Wallet” section.

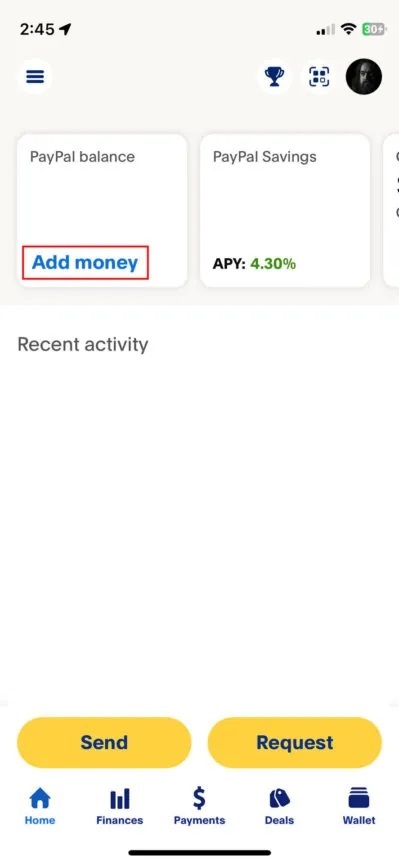

Step 4:- Add Money Using Your Bank Account:

Locate the “Add Money” option and select “From your bank account.” You’ll need to link your bank account to PayPal if you haven’t already done so.

Step 5:- Select Transfer Amount and Confirm:

Enter the amount you previously transferred from Cash App and proceed with the confirmation steps. The transfer from your bank account to PayPal typically reflects within 1-3 business days.

Remember:

- This process essentially utilizes your bank account as a middle ground to “Transfer Money from a Cash App to PayPal.”

- Double-check all bank account details before initiating the transfer to avoid delays or errors.

Alternative: Use a Third-Party Money Transfer Service

While the above method works well, there’s another option to consider: third-party money transfer services like Wise or Xoom. These services allow linking your Cash App and PayPal accounts, enabling a more direct transfer process. However, fees associated with these services might apply.

Conclusion

While a direct transfer option between Cash App and PayPal isn’t available yet, the workaround using your bank account as an intermediary is a straightforward and reliable solution. With careful planning and these steps in mind, you can successfully transfer money from Cash App to PayPal and enjoy the flexibility of managing your finances across different platforms.

Related Articles for Cash App:

- Will Cash App Refund Money If Scammed?

- How to Verify Cash App Without Id [Complete Guide]

- How to Transfer Money from Venmo to Cash App [Instant Transfer]

- Cash App Login Failed: How to Fix Common Issues

Frequently Asked Question (FAQ):-

What are the fees involved?

- Cash App charges a fee for instant transfers from your Cash App balance to your bank account (typically 1%). Standard transfers are free but take longer.

- PayPal may charge fees for receiving money depending on the transfer method. Check their fees page for details.

What is the fastest way to transfer money?

The fastest way is to use the instant transfer option from Cash App to your bank account and then transfer it to PayPal. However, this will incur a 1% fee on Cash App’s end.

Is it safe to transfer money between Cash App and PayPal?

Both Cash App and PayPal have security measures in place to protect your information. However, it’s always recommended to be cautious with any online transactions. Be wary of unsolicited requests to transfer money.